Calculate and Interpret the Close Location Value (CLV)

Close location value (CLV) is a measurement used in technical analysis to measure the closing price of an asset is relation to its high and low prices for the day. The CLV calculates within a range between +1 and -1, where a measure of +1 means that the closing price was equal to the day’s high (a bullish signal) price and -1 was equal to the day’s low price (a bearish signal).

Calculate the Close Location Value

The formula for the close location value can be written as:

CLV= ((Close – Low) – (High – Close)) / (High – Low)

Where:

Close = Closing price for the day

Low= Low price for the day

High= High price for the day

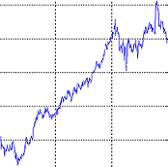

Close Location Value and the Accumulation/Distribution Line

The close location value is best known as a factor in calculating the accumulation/distribution line, a technical indicator used to measure the rate at which money flows into or out of a security. Accumulation/ distribution incorporates volume to confirm price trends or caution of movements that indicate a pending price reversal.

Accumulation: Volume is considered “accumulated” when the closing price for the day is higher than the closing price for the previous trading day.

Distribution: Volume is considered “distributed” when the closing price for the day is lower than the closing price for the previous trading day.

The “volume” part of the Accumulation/Distribution Line is factored in by multiplying volume for a given period by the close location value.

_______________________________________________________________

The above information is educational and should not be interpreted as financial advice. For advice that is specific to your circumstances, you should consult a financial or tax advisor.

« The Basics of CFD (Contract for Difference) Trading | Home | Calculate and Interpret the Accumulation/Distribution Indicator »

Leave a Comment

You must be logged in to post a comment.