Dell, Inc. Stock Investment Analysis

We ran the following analysis of Dell, Inc. using the SRP Valuation and Stock Research Pro software packages.

Disclaimer: This is not a recommendation of any kind regarding the purchase or any action on this stock. It is up to you, the investor, to make your own assessments and investment decisions.

Company Description: Dell Inc., with headquarters in Round Rock, TX, engages in the design, development, manufacturing, and sale of computer systems and services worldwide. Offering a line of devices that includes desktop systems, notebook computers, network and storage solutions, and backup systems along with consulting services and third-party software products, the company operates through telephone-based sales representatives, indirect sales channels and through online sales.

Date: 9/30/09

Sector: Technology

Industry: Personal Computer

Main Competitors: Apple (AAPL), Microsoft (MSFT), Hewlett Packard (HPQ)

Financial Ratios

- Liquidity: Current Ratio 1.46

Comment: Greater than 1.0, Indicates the company is able to meet is short-term debt obligations.

- Leverage: Debt/ Equity .74

Comment: Less than the 1.0 maximum established by many investors in this sector but higher than industry competitors MSFT and AAPL who carry no long-term debt.

- Profitability: Return on Equity (ROE) 49.41%

Comment: Greater than 20%, ROE meets criteria often looked for by growth investors and higher than primary industry competitors.

- Efficiency: Asset Turnover 42.46%

Comment: Higher than industry competitor AAPL, but lower than other primary industry competitors.

- Income: Dividend Yield N/A

Comment: Does not pay dividend to shareholders. Industry competitors MSFT (2.04%) and HPQ (.70%) do pay dividends to shareholders.

- Valuation: Price/Earnings (P/E) 16.14

Comment: Significantly lower than industry competitor AAPL (32.41); in line with other industry competitors and lower than maximum P/E for many value investors (20).

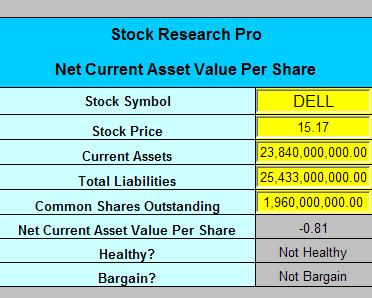

Financial Strength Analysis: NCAVPS

We also used the SRP Valuation software to run a Graham Net Current Asset Value per Share (NCAVPS) analysis, comparing current assets to total liabilities to further assess financial health. DELL currently calculates as “Not Healthy” against this very strict measure.

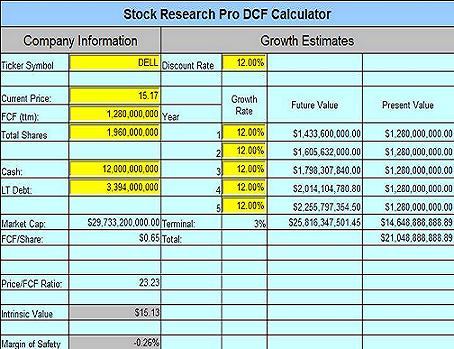

Valuation Analysis: Discounted Cash Flow

Discounted Cash Flow: Discounted Cash Flow (DCF) analysis is a measure for arriving at the fair market value of a stock under the assumption that the real or “intrinsic” value of a stock is derived by summing discounted future cash flows. The SRP Valuation software leverages a company’s free cash flow, evaluating expected growth over the next five years and terminating at 3% (average overall economic growth) thereafter.

Assuming a discount rate of 12%, DELL will need to achieve average five-year growth of about 12% to be fairly valued today.

Analyst Growth Estimates: Next Five Years, 9.38%. Click here for details.

Re-running the DCF analysis with all other factors held consistent and plugging in the analyst forecasted growth rate of 9.38% over five years calculates an intrinsic value of $14.07 for a current margin of safey of -7.03%.

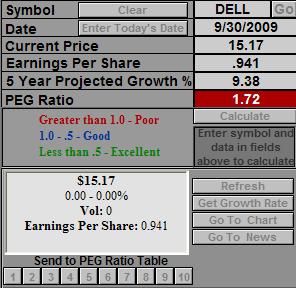

Valuation Analysis: Price/Earnings to Growth (PEG) Ratio

PEG Ratio: Compares the current P/E ratio against expected growth for the company to assess the current valuation. A fairly-valued stock (in theory) would have a PEG ratio of 1.0. An undervalued stock would be less than 1.0 and an overvalued stock would be greater than 1.0. At 1.72, DELL would be seen as overvalued by this measure.

My Thoughts: I like Dell and I buy their products- that’s always my first test when thinking about a stock for investing. Solid ROE, which I’m always looking for, but currently overvalued per the DCF/FCF and PEG tests.

-Steve

Click here to download and try to the SRP Valuation and

Stock Research Pro software packages.

________________________________________________________________

The above information is educational and should not be interpreted as financial advice. For advice that is specific to your circumstances, you should consult a financial or tax advisor.

« Is Apple (AAPL) Currently More Fairly Priced

than Microsoft (MSFT)? | Home | Five Things to Consider When Choosing

an Online Stock Broker »

Leave a Comment

You must be logged in to post a comment.