Is Apple (AAPL) Currently Overvalued?

A Discounted Cash Flow (DCF) Analysis

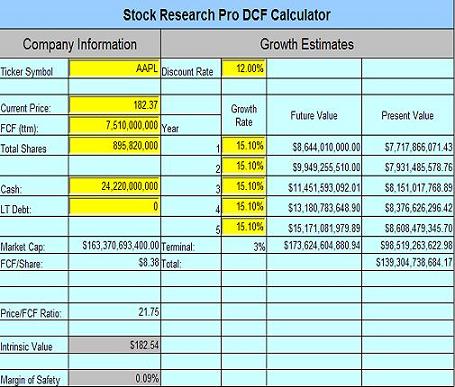

We ran the following financial health and stock valuation analysis using the SRP Valuation software package from Stock Research Pro.

Disclaimer: This is not a recommendation of any kind regarding the purchase or any action on this stock. It is up to you, the investor, to make your own assessments and investment decisions.

Date: 9/27/09

Company Description: Apple, Inc., with headquarters in Cupertino, CA, engages in the design, manufacturing, and marketing of personal computers, mobile communications devices, digital portable music players, and various peripheral and software solutions. The company sells its product lines worldwide to consumers, businesses of all size, and government entities through both online and retail stores, a direct sales force and third-party resellers.

Sector: Technology

Industry: Personal Computer

Primary Competitors: Dell (DELL), Microsoft (MSFT), Hewlett Packard (HPQ)

Financial Ratios

We used the Ratios module in the SRP Valuation software to arrive at the following values:

- Liquidity: Current Ratio 2.11

Comment: Greater than 1.0, Indicates the company is able to meet is short-term debt obligations.

- Leverage: Debt/ Equity N/A (AAPL has no long-term debt)

Comment: Less than 0.5, Very favorable.

- Profitability: Return on Equity (ROE) 21.99%

Comment: Greater than 20%, ROE meets criteria often looked for by growth investors.

- Efficiency: Asset Turnover 17.32%

- Income: Dividend Yield N/A

Comment: No income opportunity through dividends. Industry competitors MSFT and HPQ do provide shareholder income through dividends.

- Valuation: Price/Earnings (P/E) 31.88

Comment: Significantly higher than industry competitors MSFT (15.78), DELL (16.3), and HPQ (15.83) and higher than maximum P/E often sought after by value investors (20)

Note: We also used the SRP Valuation software to run a Graham Net Current Asset Value per Share (NCAVPS) analysis, comparing current assets to total liabilities to further assess financial health. AAPL currently calculates as “Healthy” against this very strict measure.

Valuation Analysis

Discounted Cash Flow: Discounted Cash Flow (DCF) analysis is a measure for arriving at the fair market value of a stock under the assumption that the real or “intrinsic” value is derived by summing discounted future cash flows. The SRP Valuation software leverages a company’s free cash flow, evaluating expected growth over the next five years and terminating at 3% (average overall economic growth) thereafter.

Assuming a discount rate of 12%, Apple will need to achieve average five-year growth of about 15.1% to be fairly valued today.

Analyst Growth Estimates: Next Five Years, 18.02%. Click here for details.

Re-running the DCF analysis with all other factors held consistent and plugging in the analyst forecasted growth rate of 18.02% over five years calculates an intrinsic value of $200.87 for a current margin of safey of 10.14%.

My Thoughts: This one is speculative, but one could easily argue that with growth opportunities abroad (particularly for the iPhone) and solid ROE, it could support its current valuation. Obviously, a lot of investors feel that way about AAPL.

-Steve

Click here to download and try to the SRP Valuation and

Stock Research Pro software packages.

________________________________________________________________

The above information is educational and should not be interpreted as financial advice. For advice that is specific to your circumstances, you should consult a financial or tax advisor.

« Calculate the Coupon Equivalent Rate | Home | Is Apple (AAPL) Currently More Fairly Priced

than Microsoft (MSFT)? »

Leave a Comment

You must be logged in to post a comment.