Working with a Discounted Cash Flow Calculator

for Stock Valuation

In using the Discounted Cash Flow (DCF) approach for stock valuation, the investor recognizes that a company is worth the total amount of cash it will generate over its lifetime. Those cash flows, however, must be discounted to their present value in order to assign a current, “intrinsic” value to the company and, by extension, its stock.

What Value is there in Stock Ownership?

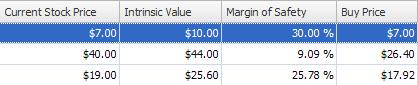

A company is valuable to stockholders only if it is expected to generate cash in the future, just like bonds do for a bondholder. Unlike the cash that a bondholder expects though, future company profits are less certain. The job of the stock investor is to make a reasonable and well-informed prediction about the future earnings of the company and then “discount” them to a present value. A decision to purchase is made when the present value proves to be greater than the current price of the stock. The greater the difference between the current value and the current price, the wider the “margin of safety” to the investor.

The Discounted Cash Flow Approach

The DCF approach to stock valuation is a method for valuing a stock under which the present value of future cash flows is determined by discounting these cash flows appropriately. This discounting is necessary because cash flows in different time periods are not equally valued; given the time value of money, most people prefer to receive their money sooner rather than later. The same logic applies to the difference between certain cash flows and uncertain cash flows.

Discounting Future Cash Flows

In discounting future cash flows, you multiply these by a number less than one which represents the discount rate. The rate that you use for this valuation depends upon the timing and the risks associated with these future cash flows. A higher discount rate represents a more conservative approach in conducting your valuations. Many value investors simply apply a hurdle rate which is the minimum amount of return they require before they will make an investment.

The Stock Research Pro Valuation Software for DCF Stock Valuation Analysis

The SRP Valuation software offers three modules to assess the value of a stock and the health of a company:

• Discounted Cash Flow (DCF)

• Net Current Asset Value per Share (NCAVPS)

• Dividend Discount Model (DDM)

Each module includes a video tutorial to guide you through the process. Click here to watch the discounted cash flow tutorial.

_______________________________________________________________

The above information is educational and should not be interpreted as financial advice. For advice that is specific to your circumstances, you should consult a financial or tax advisor.

« Return on Equity (ROE) in Stock Analysis

(includes calculator) | Home | Investing in Gold in an Uncertain Economy »

Leave a Comment

You must be logged in to post a comment.